Brokers Supporting Social Trading

The ForexReviews.nl comparison tool rigorously compares forex brokers on factors like fees, platforms, licenses, apps, spreads, and ratings. Filter and narrow down brokers to find the ones that best suit your preferences compared to its competitors.

Plus500 is a CFD provider and they offer CFD service. All the instruments, including the Forex pairs, are available for trading through CFD

How To Compare Additional Forex Brokers?

You can add forex brokers to the comparison table by clicking on +Name.

|

Add/remove a broker for comparison: |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Remove |

Rating |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Overall Rating | 4.5 | 4.5 | 4.5 | 4.5 | 4.5 | 4.5 | 4.5 | 4.5 | 4 | 4 | 4 | 4.5 |

| Offering of Investments | 4 | 4 | 4 | 4 | 4.5 | 3.5 | 4 | 4 | 5 | 3.5 | 5 | 4.5 |

| Commissions & Fees | 4 | 4.5 | 4.5 | 5 | 3.5 | 5 | 4 | 4.5 | 3.5 | 4 | 4.5 | 4.5 |

| Platform & Tools | 4 | 4.5 | 4 | 4 | 4.5 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| Research | - | 4 | 4.5 | - | 4.5 | 4 | 4 | 4 | 3.5 | 4 | 4 | 4 |

| Mobile Trading | 4 | 4.5 | 4 | 5 | 4.5 | 4 | 4.5 | 4 | 4 | 4 | 4 | 4.5 |

| Education | - | 5 | 4 | - | 4 | 4 | 4 | 4 | 3 | 3.5 | 4 | 4.5 |

| Trustpilot Reviews | 551 | 8253 | 2111 | 863 | 2105 | 498 | 191 | 5484 | 383 | 6530 | 14 | 3063 |

| Trustpilot Rating | 3.2 | 4.7 | 4.4 | 4 | 3.7 | 3.6 | 3.9 | 4.6 | 4.2 | 4.5 | 4.3 | 4.5 |

| Trustpilot Profile | View | View | View | View | View | View | View | View | View | View | View | View | Licenses |

| Tier 1 Licenses | 2 | 6 | 2 | 1 | - | - | 2 | - | - | - | - | - |

| Tier 2 Licenses | 1 | 3 | 2 | 3 | - | - | 1 | - | - | - | - | - |

| Tier 3 Licenses | 1 | 0 | 1 | 1 | - | - | - | - | - | - | - | - |

| Licenses | - | 9 | - | - | 6 | 4 | 3 | 6 | 3 | 2 | 2 | - | Investments |

| Forex Trading (Spot or CFDs) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ |

| Forex Pairs (Total) | 1429 | 65 | 62 | 57 | 78 | 63 | 70 | 107 | 36 | 40 | 72 | - |

| Tradeable Symbols (Total) | 55 | 5500 | 2342 | 6010 | 472 | 725 | 2249 | 100 | 12000 | 229 | 26000 | - |

| U.S. Stock Trading (Non CFD) | ✅ | ✅ | no | ✅ | ✅ | no | no | ✅ | no | no | ✅ | ✅ |

| Int'l Stock Trading (Non CFD) | ✅ | ✅ | no | ✅ | ✅ | no | ✅ | no | no | no | ✅ | no |

| Social Trading / Copy Trading | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Cryptocurrency (Physical) | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| Cryptocurrency (CFD) | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Crypto Pairs (CFD) | 58 | 16 | 9 | 46 | 34 | - | 28 | 11 | - | - | 10 | - | Assets |

| CFDs | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| ETFs | no | no | ✅ | no | no | no | no | no | ✅ | no | ✅ | ✅ |

| Forex | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Indices | ✅ | no | ✅ | no | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ |

| Shares | ✅ | ✅ | ✅ | ✅ | no | no | no | no | no | no | ✅ | ✅ |

| Commodities | ✅ | no | ✅ | no | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ |

| Oil Trading | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | Licensing Jurisdiction |

| ASIC Authorised (Australia) | ✅ | ✅ | ✅ | no | no | no | no | no | no | no | no | no |

| IIROC Authorised (Canada) | no | ✅ | no | no | no | no | no | no | no | no | no | no |

| SFC Authorised (Hong Kong) | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| CBI Authorised (Ireland) | no | ✅ | no | no | no | no | no | no | no | no | no | no |

| FSA Authorised (Japan) | no | ✅ | no | no | no | no | no | ✅ | no | no | no | no |

| MAS Authorised (Singapore) | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| FINMA Authorised (Switzerland) | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| FCA Authorised (U.K.) | ✅ | no | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | no | no | no |

| CFTC Registered (USA) | ✅ | no | no | no | no | no | no | no | no | no | no | no |

| FMA Authorised (New Zealand) | no | no | no | no | no | no | no | no | no | no | ✅ | no |

| CBRC Authorised (China) | no | no | no | no | no | no | no | no | no | no | no | no |

| CySEC Authorised (Cyprus) | ✅ | ✅ | ✅ | ✅ | no | no | no | ✅ | no | ✅ | no | ✅ |

| SEBI Authorised (India) | no | no | no | no | no | no | no | no | no | no | no | no |

| Israel (ISA Authorised) | no | ✅ | no | no | no | no | no | no | no | no | no | no |

| CBR Authorised (Russia) | no | ✅ | no | ✅ | no | no | no | no | no | no | no | no |

| FSCA Authorised (South Africa) | no | no | no | no | no | no | ✅ | ✅ | no | ✅ | no | no |

| SEC Authorised (Thailand) | no | ✅ | ✅ | ✅ | no | no | no | no | no | no | no | no |

| DFSA / Central Bank Authorised (UAE) | no | no | ✅ | no | no | no | no | no | no | no | no | no |

| SCB Authorised (Bahamas) | ✅ | no | no | ✅ | no | no | no | no | no | no | no | no |

| FSC Authorised (Belize) | no | no | no | no | no | no | no | ✅ | ✅ | no | no | no |

| FSA Authorised (Seychelles) | no | no | no | no | no | no | no | no | no | no | ✅ | no |

| CIMA Authorised (Cayman Islands) | no | no | no | no | no | no | no | no | no | no | no | no |

| BMA Authorised (Bermuda) | no | ✅ | no | no | no | no | no | no | no | no | no | no |

| FSC Authorised (British Virgin Islands) | no | no | no | no | no | no | no | no | no | no | no | no |

| FSC Authorised (Mauritius) | no | no | no | no | no | no | no | ✅ | no | no | no | no |

| VFSC Authorised (Vanuatu) | no | no | no | no | no | no | no | no | no | no | no | no |

| EFSA Authorised (Estonia) | no | no | no | no | no | no | no | no | no | no | no | no | Funding |

| Min. Deposit | 5 | 0 | 0 | 0 | 1000 | - | 100 | 10 | 100 | 50 | 0 | 250 |

| PayPal (Deposit/Withdraw) | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | no |

| Skrill (Deposit/Withdraw) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Visa/Mastercard (Credit/Debit) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Bank Wire (Deposit/Withdraw) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Webmoney (Deposit/Withdraw) | no | no | no | no | no | no | no | ✅ | no | no | no | no | Crypto Funding |

| Bitcoin (BTC) | no | no | no | no | no | no | no | no | no | ✅ | no | no |

| Litecoin (LTC) | no | no | no | no | no | no | no | no | no | ✅ | no | no |

| Ethereum (ETH) | no | no | no | no | no | no | no | no | no | ✅ | no | no |

| Tether (ERC20) | no | no | no | no | no | no | no | no | no | ✅ | no | no |

| Tether (TRC20) | no | no | no | no | no | no | no | no | no | ✅ | no | no |

| Dogecoin (DOGE) | no | no | no | no | no | no | no | no | no | ✅ | no | no | Trading Platforms |

| Proprietary Platform | no | ✅ | no | ✅ | ✅ | no | ✅ | ✅ | no | ✅ | no | ✅ |

| Desktop Platform (Windows) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Desktop Platform (Mac) | no | no | no | no | no | ✅ | no | no | no | no | no | no |

| Web Platform | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Social Trading / Copy Trading | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Mobile App (Android) | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | no | ✅ | no |

| Mobile App (iOS) | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | no | ✅ | no | Trading Software |

| MetaTrader 4 (MT4) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| MetaTrader 5 (MT5) | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| cTrader | no | no | ✅ | no | no | no | no | no | no | no | no | no |

| DupliTrade | no | ✅ | ✅ | no | no | no | no | no | no | no | no | no |

| ZuluTrade | no | ✅ | no | no | no | no | no | no | no | no | ✅ | no |

| Myfxbook | no | no | no | no | no | no | no | no | no | no | ✅ | no |

| VPS Trading | no | no | no | no | no | no | no | no | no | no | ✅ | no | Cost |

| Average Spread EUR/USD - Standard | 1.6 | 0.92 | 0.77 | 1.07 | - | 0.51 | 1.51 | - | 1.40 | 0.98 | 0.827 | - |

| All-in Cost EUR/USD - Active | 0.8 | 0.61 | 0.87 | 1.04 | - | 0.31 | 1.27 | - | - | 0.82 | 0.827 | - |

| Active Trader or VIP Discounts | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | no | ✅ | ✅ | no |

| Inactivity Fee | no | no | no | no | no | no | no | no | no | ✅ | no | no |

| Execution: Agency Broker | no | no | ✅ | ✅ | no | no | ✅ | no | no | ✅ | no | no |

| Execution: Market Maker | ✅ | ✅ | ✅ | ✅ | no | no | ✅ | ✅ | ✅ | ✅ | no | ✅ | Research |

| Daily Market Commentary | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Forex News (Top-Tier Sources) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | no |

| Autochartist | no | no | ✅ | no | ✅ | ✅ | no | no | no | ✅ | ✅ | no |

| Trading Central (Recognia) | ✅ | ✅ | no | no | ✅ | no | ✅ | ✅ | no | no | no | no |

| Social Sentiment - Currency Pairs | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | no | no | no | no |

| Economic Calendar | ✅ | ✅ | ✅ | ✅ | no | no | no | ✅ | ✅ | ✅ | no | no |

| Education (Forex or CFDs) | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Client Webinars | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | no | ✅ | ✅ | ✅ | no |

| Client Webinars (Archived) | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Videos - Beginner Trading Videos | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | no | ✅ | ✅ | no |

| Videos - Advanced Trading Videos | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | no | no | ✅ | ✅ | no |

| Investor Dictionary (Glossary) | no | ✅ | ✅ | no | ✅ | ✅ | ✅ | no | no | ✅ | ✅ | no |

| Tick History | no | no | no | no | no | no | no | ✅ | no | no | no | no | Major Forex Pairs |

| GBP/USD | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| USD/JPY | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| EUR/USD | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| USD/CHF | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| USD/CAD | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| NZD/USD | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| AUD/USD | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | Mobile Trading |

| Android App | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Apple iOS App | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Mobile Alerts - Basic Fields | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no |

| Mobile Watchlist | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Watchlist Syncing | ✅ | ✅ | ✅ | no | no | no | ✅ | no | ✅ | no | ✅ | no |

| Mobile Charting - Indicators / Studies | 30 | 73 | 30 | 39 | 49 | 30 | 53 | - | 30 | 30 | 30 | - |

| Mobile Charting - Draw Trendlines | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Mobile Charting - Multiple Time Frames | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no |

| Mobile Charting - Drawings Autosave | no | no | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | no |

| Forex Calendar | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | ✅ | no | Trading Tools |

| Virtual Trading (Demo) | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | ✅ | ✅ | ✅ | ✅ |

| Alerts - Basic Fields | ✅ | ✅ | ✅ | ✅ | no | no | no | no | ✅ | ✅ | no | no |

| Watchlists - Total Fields | 7 | 7 | 7 | 8 | 10 | 7 | 6 | - | 7 | 7 | 7 | - |

| Charting - Indicators / Studies (Total) | 30 | 80 | 15 | 39 | 49 | 30 | 53 | - | 30 | 30 | 30 | - |

| Charting - Drawing Tools (Total) | 15 | 13 | 30 | 32 | 275 | 15 | 25 | - | 15 | 15 | 15 | - |

| Charting - Trade From Chart | ✅ | ✅ | ✅ | ✅ | no | ✅ | no | no | ✅ | ✅ | ✅ | no |

| Charts can be saved | ✅ | ✅ | ✅ | ✅ | no | no | no | no | ✅ | ✅ | no | no | Spread |

| Stocks | - | - | - | - | - | - | - | - | - | - | - | - |

| Currencies | - | - | - | - | - | - | - | - | - | - | - | - |

| Indices | - | - | - | - | - | - | - | - | - | - | - | - |

| Commodities | - | - | - | - | - | - | - | - | - | - | - | - | Max. Leverage |

| Overall Max. Leverage | 1:888 | 1:400 | - | - | 1:100 | 1:500 | - | 1:2000 | 1:2000 | 1:500 | 1:500 | 1:30 |

| Stocks | - | - | - | - | - | - | - | - | - | - | - | - |

| Currencies | - | - | - | - | - | - | - | - | - | - | - | - |

| Indices | - | - | - | - | - | - | - | - | - | - | - | - |

| Commodities | - | - | - | - | - | - | - | - | - | - | - | - | Features |

| Scalping | ✅ | ✅ | no | ✅ | no | no | no | ✅ | ✅ | ✅ | ✅ | ✅ |

| Hedging | ✅ | no | no | ✅ | no | no | no | ✅ | no | ✅ | ✅ | ✅ |

| Trailing Stops | ✅ | ✅ | no | ✅ | no | no | no | no | no | no | ✅ | ✅ |

| Guaranteed Stop Loss | no | ✅ | no | no | no | no | no | no | no | no | no | no |

| Guaranteed Limit Orders | no | ✅ | no | no | no | no | no | no | no | no | no | no |

| Guaranteed Execution | no | no | no | no | no | no | no | no | no | no | no | no |

| Negative Balance Protection | ✅ | no | no | no | no | no | no | ✅ | no | no | ✅ | ✅ |

| One-click Execution | ✅ | ✅ | no | ✅ | no | no | no | ✅ | no | ✅ | ✅ | no |

| Interest on Margin | no | no | no | no | no | no | no | ✅ | no | no | no | no |

| Demo Account | ✅ | no | no | no | no | ✅ | no | ✅ | no | no | no | ✅ |

| Web-based Trading | ✅ | ✅ | no | ✅ | no | no | no | no | no | no | ✅ | ✅ |

| Mobile Native App Trading | ✅ | ✅ | no | ✅ | no | no | no | no | no | no | ✅ | ✅ |

| Islamic Account | ✅ | no | no | no | no | ✅ | no | ✅ | no | ✅ | no | ✅ |

| Zero Spreads | no | no | ✅ | no | no | ✅ | no | no | no | no | no | no | Regulation |

| Trust Score | 90 | 93 | 93 | 96 | - | 83 | 90 | 95 | 71 | 70 | 77 | - |

| Year Founded | 2009 | 2006 | 2010 | 2002 | 1996 | 2014 | 2006 | 2008 | 2009 | 2011 | 2014 | 2015 |

| Compensation Fund | 20000 | 20000 | 85000 | 20000 | - | - | - | 20000 | 20000 | 20000 | 15000 | 20000 |

| Publicly Traded (Listed) | no | no | no | ✅ | ✅ | no | no | no | no | no | no | no |

| Bank | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| Authorised in European Union | ✅ | ✅ | ✅ | ✅ | ✅ | no | ✅ | ✅ | no | ✅ | no | no |

| Member of The Financial Commission | no | no | ✅ | no | no | no | no | ✅ | ✅ | no | no | no |

| The Financial Commission Profile | - | - | View | - | - | - | - | View | View | - | - | - |

| VerifyMyTrade Audit | - | - | - | - | - | - | - | - | View | - | - | - | Public Disclosures |

| Financial Statements | - | View | - | View | View | - | View | View | - | View | - | - |

| Management Team | - | View | - | View | View | - | View | View | - | - | - | - | Support |

| Email Support | ✅ | no | no | no | ✅ | ✅ | no | ✅ | no | ✅ | no | ✅ |

| Phone Support | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| SMS Support | no | no | no | no | no | no | no | no | no | no | no | no |

| Live Chat | no | no | no | no | ✅ | no | no | no | no | no | no | no |

| Support Hours | 24/7 | - | - | - | - | - | - | 24/7 | - | 24/7 | - | 24/5 | Community |

| Monthly Website Visitors | 11.6 M | 750 K | 677 K | 6.5 M | 456 K | 607 K | 662 K | 25.8 M | 5.2 M | 3.5 M | 312 K | 207 K |

| X Subscribers | 115 K | 18 K | 32 K | 4 K | 27 K | 0 | 36 K | 70 K | 25 K | 37 K | 11 K | 10 K |

| Youtube Subscribers | 104 K | 23 K | 229 K | 6 K | 20 K | 0 | 45 K | 81 K | 9 K | 1.0 M | 9 K | 9 K |

Can you trust XM?

- XM was founded in 2009.

- XM does not operate a bank and is not publicly traded.

- XM is authorised to operate in the 🇪🇺 European Union.

- XM is licensed by the world's most strict and feared regulator 🇬🇧 ASIC (AU).

- XM is licensed by the 🇬🇧 FCA (UK).

- XM is registered by the 🇺🇸 CFTC (USA) .

Is XM authorised to operate in the US?

✅ Yes, XM is CFTC Registered (USA) which means that you are allowed to trade (Futures only) on their platform if you are based in the United States.What licenses does XM have to operate?

XM is authorised by the following regulators: ASIC Authorised (Australia), FCA Authorised (U.K.) , CFTC Registered (USA) , CySEC Authorised (Cyprus) and SCB Authorised (Bahamas) .Does XM publicly discloses their financial statements?

❌ No, unfortunately XM does not list their financial statements publicly on their website.Does XM offer trading software like Meta Trader?

✅ Yes, you can trade on XM using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their web trading platform .Does XM provide a mobile native app?

✅ Yes, you can trade XM on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust AvaTrade?

- AvaTrade was founded in 2006.

- AvaTrade does not operate a bank and is not publicly traded.

- AvaTrade is authorised to operate in the 🇪🇺 European Union.

- AvaTrade is licensed by the world's most strict and feared regulator 🇬🇧 ASIC (AU).

Is AvaTrade authorised to operate in the US?

❌ No, AvaTrade is not authorised to operate in the United States.What licenses does AvaTrade have to operate?

AvaTrade is authorised by the following regulators: ASIC Authorised (Australia), IIROC Authorised (Canada), CBI Authorised (Ireland), FSA Authorised (Japan), CySEC Authorised (Cyprus), Israel (ISA Authorised), CBR Authorised (Russia), SEC Authorised (Thailand) and BMA Authorised (Bermuda) .Does AvaTrade publicly discloses their financial statements?

✅ Yes, you can view the financial statements of AvaTrade onlineDoes AvaTrade offer trading software like Meta Trader?

✅ Yes, you can trade on AvaTrade using MetaTrader 4 (MT4), MetaTrader 5 (MT5), DupliTrade and ZuluTrade trading software as well as through their proprietary trading platform .Does AvaTrade provide a mobile native app?

No, AvaTrade does not provide a native app for mobile. However, you can access the AvaTrade web platform on mobile for trading.Can you trust Pepperstone?

- Pepperstone was founded in 2010.

- Pepperstone does not operate a bank and is not publicly traded.

- Pepperstone is authorised to operate in the 🇪🇺 European Union.

- Pepperstone is licensed by the world's most strict and feared regulator 🇬🇧 ASIC (AU).

- Pepperstone is licensed by the 🇬🇧 FCA (UK).

Is Pepperstone authorised to operate in the US?

❌ No, Pepperstone is not authorised to operate in the United States.What licenses does Pepperstone have to operate?

Pepperstone is authorised by the following regulators: ASIC Authorised (Australia), FCA Authorised (U.K.) , CySEC Authorised (Cyprus), SEC Authorised (Thailand) and DFSA / Central Bank Authorised (UAE) .Does Pepperstone publicly discloses their financial statements?

❌ No, unfortunately Pepperstone does not list their financial statements publicly on their website.Does Pepperstone offer trading software like Meta Trader?

✅ Yes, you can trade on Pepperstone using MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and DupliTrade trading software as well as through their web trading platform .Does Pepperstone provide a mobile native app?

✅ Yes, you can trade Pepperstone on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust XTB?

- XTB was founded in 2002.

- XTB does not operate a bank and is publicly traded.

- XTB is authorised to operate in the 🇪🇺 European Union.

- XTB is licensed by the 🇬🇧 FCA (UK).

Is XTB authorised to operate in the US?

❌ No, XTB is not authorised to operate in the United States.What licenses does XTB have to operate?

XTB is authorised by the following regulators: FCA Authorised (U.K.) , CySEC Authorised (Cyprus), CBR Authorised (Russia), SEC Authorised (Thailand) and SCB Authorised (Bahamas) .Does XTB publicly discloses their financial statements?

✅ Yes, you can view the financial statements of XTB onlineDoes XTB offer trading software like Meta Trader?

✅ Yes, you can trade on XTB using MetaTrader 4 (MT4) trading software as well as through their proprietary trading platform .Does XTB provide a mobile native app?

✅ Yes, you can trade XTB on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust Swissquote?

- Swissquote was founded in 1996.

- Swissquote operates a bank and is publicly traded.

- Swissquote is authorised to operate in the 🇪🇺 European Union.

- Swissquote is licensed by the 🇬🇧 FCA (UK).

Is Swissquote authorised to operate in the US?

❌ No, Swissquote is not authorised to operate in the United States.What licenses does Swissquote have to operate?

Swissquote is authorised by the following regulators: SFC Authorised (Hong Kong), MAS Authorised (Singapore), FINMA Authorised (Switzerland) and FCA Authorised (U.K.) .Does Swissquote publicly discloses their financial statements?

✅ Yes, you can view the financial statements of Swissquote onlineDoes Swissquote offer trading software like Meta Trader?

✅ Yes, you can trade on Swissquote using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their proprietary trading platform .Does Swissquote provide a mobile native app?

✅ Yes, you can trade Swissquote on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust Tickmill?

- Tickmill was founded in 2014.

- Tickmill does not operate a bank and is not publicly traded.

- Tickmill is not authorised to operate in the 🇪🇺 European Union.

Is Tickmill authorised to operate in the US?

❌ No, Tickmill is not authorised to operate in the United States.What licenses does Tickmill have to operate?

Tickmill is authorised by the following regulators: .Does Tickmill publicly discloses their financial statements?

❌ No, unfortunately Tickmill does not list their financial statements publicly on their website.Does Tickmill offer trading software like Meta Trader?

✅ Yes, you can trade on Tickmill using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their web trading platform .Does Tickmill provide a mobile native app?

✅ Yes, you can trade Tickmill on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust FxPro?

- FxPro was founded in 2006.

- FxPro does not operate a bank and is not publicly traded.

- FxPro is authorised to operate in the 🇪🇺 European Union.

- FxPro is licensed by the 🇬🇧 FCA (UK).

Is FxPro authorised to operate in the US?

❌ No, FxPro is not authorised to operate in the United States.What licenses does FxPro have to operate?

FxPro is authorised by the following regulators: FCA Authorised (U.K.) and FSCA Authorised (South Africa) .Does FxPro publicly discloses their financial statements?

✅ Yes, you can view the financial statements of FxPro onlineDoes FxPro offer trading software like Meta Trader?

✅ Yes, you can trade on FxPro using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their proprietary trading platform .Does FxPro provide a mobile native app?

✅ Yes, you can trade FxPro on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust Exness?

- Exness was founded in 2008.

- Exness does not operate a bank and is not publicly traded.

- Exness is authorised to operate in the 🇪🇺 European Union.

- Exness is licensed by the 🇬🇧 FCA (UK).

Is Exness authorised to operate in the US?

❌ No, Exness is not authorised to operate in the United States.What licenses does Exness have to operate?

Exness is authorised by the following regulators: FSA Authorised (Japan), FCA Authorised (U.K.) , CySEC Authorised (Cyprus), FSCA Authorised (South Africa) and FSC Authorised (Belize) .Does Exness publicly discloses their financial statements?

✅ Yes, you can view the financial statements of Exness onlineDoes Exness offer trading software like Meta Trader?

✅ Yes, you can trade on Exness using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their proprietary trading platform .Does Exness provide a mobile native app?

No, Exness does not provide a native app for mobile. However, you can access the Exness web platform on mobile for trading.Can you trust RoboForex?

- RoboForex was founded in 2009.

- RoboForex does not operate a bank and is not publicly traded.

- RoboForex is not authorised to operate in the 🇪🇺 European Union.

Is RoboForex authorised to operate in the US?

❌ No, RoboForex is not authorised to operate in the United States.What licenses does RoboForex have to operate?

RoboForex is authorised by the following regulators: FSC Authorised (Belize) .Does RoboForex publicly discloses their financial statements?

❌ No, unfortunately RoboForex does not list their financial statements publicly on their website.Does RoboForex offer trading software like Meta Trader?

✅ Yes, you can trade on RoboForex using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their web trading platform .Does RoboForex provide a mobile native app?

✅ Yes, you can trade RoboForex on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust OctaFX?

- OctaFX was founded in 2011.

- OctaFX does not operate a bank and is not publicly traded.

- OctaFX is authorised to operate in the 🇪🇺 European Union.

Is OctaFX authorised to operate in the US?

❌ No, OctaFX is not authorised to operate in the United States.What licenses does OctaFX have to operate?

OctaFX is authorised by the following regulators: CySEC Authorised (Cyprus) and FSCA Authorised (South Africa) .Does OctaFX publicly discloses their financial statements?

✅ Yes, you can view the financial statements of OctaFX onlineDoes OctaFX offer trading software like Meta Trader?

✅ Yes, you can trade on OctaFX using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their proprietary trading platform .Does OctaFX provide a mobile native app?

No, OctaFX does not provide a native app for mobile. However, you can access the OctaFX web platform on mobile for trading.Can you trust Blackbull?

- Blackbull was founded in 2014.

- Blackbull does not operate a bank and is not publicly traded.

- Blackbull is not authorised to operate in the 🇪🇺 European Union.

Is Blackbull authorised to operate in the US?

❌ No, Blackbull is not authorised to operate in the United States.What licenses does Blackbull have to operate?

Blackbull is authorised by the following regulators: FMA Authorised (New Zealand) .Does Blackbull publicly discloses their financial statements?

❌ No, unfortunately Blackbull does not list their financial statements publicly on their website.Does Blackbull offer trading software like Meta Trader?

✅ Yes, you can trade on Blackbull using MetaTrader 4 (MT4), MetaTrader 5 (MT5) and ZuluTrade trading software as well as through their web trading platform .Does Blackbull provide a mobile native app?

✅ Yes, you can trade Blackbull on mobile using Mobile App (Android) and Mobile App (iOS).Can you trust Naga?

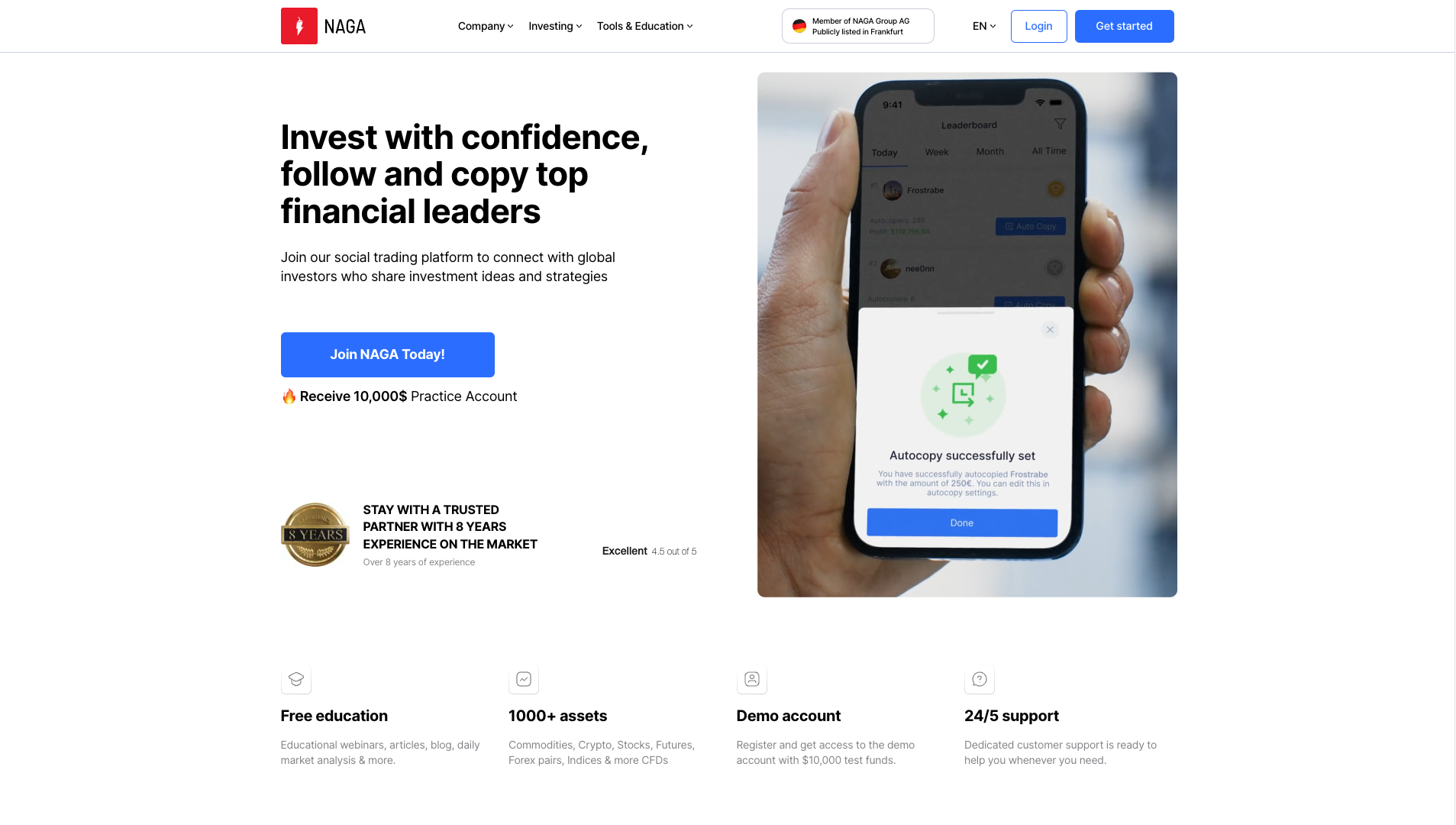

- Naga was founded in 2015.

- Naga does not operate a bank and is not publicly traded.

- Naga is not authorised to operate in the 🇪🇺 European Union.

Is Naga authorised to operate in the US?

❌ No, Naga is not authorised to operate in the United States.What licenses does Naga have to operate?

Naga is authorised by the following regulators: CySEC Authorised (Cyprus) .Does Naga publicly discloses their financial statements?

❌ No, unfortunately Naga does not list their financial statements publicly on their website.Does Naga offer trading software like Meta Trader?

✅ Yes, you can trade on Naga using MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading software as well as through their proprietary trading platform .Does Naga provide a mobile native app?

No, Naga does not provide a native app for mobile.Comparison & Key Differences

Which brokers offer social/copy trading?

The following brokers offer social/copy trading: XM, AvaTrade, Pepperstone, XTB, Swissquote, Tickmill, FxPro, Exness, RoboForex, OctaFX, Blackbull and Naga.Best Brokers for Social/Copy Trading

Which brokers offer cryptocurrency (CFD) trading?

The following brokers offer cryptocurrency (CFD) trading: XM, AvaTrade, Pepperstone, XTB, Tickmill, FxPro, Exness, RoboForex, OctaFX and Blackbull.Best Brokers for Cryptocurrency (CFD)

Which brokers allow scalping?

The following brokers allow scalping: XM, AvaTrade, XTB, Exness, RoboForex, OctaFX, Blackbull and Naga.Which brokers allow hedging?

The following brokers allow hedging: XM, XTB, Exness, OctaFX, Blackbull and Naga.Which brokers provide Negative Balance Protection?

The following brokers provide Negative Balance Protection: XM, Exness, Blackbull and Naga.Best Brokers with Negative Balance Protection

Which brokers offer a Demo Account?

The following brokers offer an Demo Account: XM, Tickmill, Exness and Naga.Best Brokers Offering Demo Accounts

Which brokers offer an Islamic Account?

The following brokers offer an Islamic Account: XM, Tickmill, Exness, OctaFX and Naga.Best Brokers Supporting Islamic Accounts

What does it matter which licenses a broker has?

Licenses allow brokers like XM, AvaTrade, Pepperstone, XTB, Swissquote, Tickmill, FxPro, Exness, RoboForex, OctaFX, Blackbull and Naga to legally provide services in those countries or regions. By having permits from regulators globally, the broker is authorized to conduct business and operate globally.

These licenses and regulations are good for consumers because they hold these companies to high standards.

For example, licenses from:

Require that XM, AvaTrade, Pepperstone, XTB, Swissquote, Tickmill, FxPro, Exness, RoboForex, OctaFX, Blackbull and Naga follow rules around:

- Keeping customer money safe

Regulators make sure brokers keep client money separate from their own money. This stops brokers from spending customer money. - Providing clear fees and charges

Regulators check that brokers show all fees to customers upfront. This helps customers understand and compare costs. - Resolving complaints fairly

Regulators check brokers are dealing with customer complaints fairly. Brokers must have policies to fix complaints. -

Guarding against fraud

Regulators make rules so brokers check customer identities. This helps stop criminal activity. Regulators can punish cheating brokers. - Advertising honestly

Regulators tell brokers what they can and can't say in ads. This stops brokers making false promises. Regulators can fine brokers who break ad rules.

Which brokers are authorised by ASIC, FCA, CFTC and CFTC?

AU's ASIC, UK's FCA and America's CFTC are considered global “gold standards” in rigorous consumer protection laws and enforcement policies.

- ASIC (AU) Authorised - The following brokers are licensed by the ASIC (AU): XM, AvaTrade and Pepperstone.

- FCA (UK) Authorised - The following brokers are licensed by the FCA (UK): XM, Pepperstone, XTB, Swissquote, FxPro and Exness.

- CFTC (US) Authorised - Only XM is licensed by the CFTC (US).

CySEC in Cyprus follows the strict rules set by the European Union called MiFID. These MiFID rules were created to strongly protect investors.

- CySEC (CY) Authorised - The following brokers are licensed by the CySEC (CY): XM, AvaTrade, Pepperstone, XTB, Exness, OctaFX and Naga.

Which brokers are not registered with ASIC, FCA or CFTC?

-

Not registered with CFTC (US) -

The following brokers are not licensed by the CFTC (US): AvaTrade, Pepperstone, XTB, Swissquote, Tickmill, FxPro, Exness, RoboForex, OctaFX, Blackbull and Naga.

This doesn't necessarily have to be a red flag as some forex brokers make the choice to only have customers who live outside of the United States. They do not accept traders who live inside the U.S. The CFTC is the agency in the U.S. that oversees brokers for U.S. residents. Since these brokers don't have any U.S. customers, the rules and registration enforced by the CFTC does not apply to those brokers. The brokers are still responsible for following the local rules where their international customers live. But they do not have to register specifically with the U.S. agency (CFTC) because they do not serve traders who reside in the United States.

-

Not registered with ASIC (AU) -

The following brokers are not licensed by the ASIC (AU): XTB, Swissquote, Tickmill, FxPro, Exness, RoboForex, OctaFX, Blackbull and Naga.

Again, even though ASIC is known globally as having the strictest and most feared regulation of forex brokers, this doesn't always have to ring alarms. However, some brokers deliberately avoid Australia because ASIC aggressively examines brokers in detail and has very high standards of acceptable conduct. If ASIC finds brokers are badly mistreating customers or ignoring the strict rules, ASIC will punish them severely without waiting by issuing massive fines or shutting them down. Forex brokers know not to take ASIC rules lightly because ASIC is watching them closely and will come down hard on them if customers are harmed by their poor behavior.

-

Not registered with FCA (GB) -

The following brokers are not licensed by the FCA (GB): AvaTrade, Tickmill, RoboForex, OctaFX, Blackbull and Naga.

Background Information

Difference between shares, equity indices and , individual stocks and etfs

The main differences between forex, shares, equity indices, individual stocks, and ETFs are:

- Forex (Foreign Exchange) - Forex trading involves exchanging one currency for another in the foreign exchange market. Forex traders attempt to profit from fluctuations in currency exchange rates.

- Shares - A share represents part ownership of a company. Owning shares entitles the shareholder to a portion of the company's assets and earnings.

- Equity Indices - An equity index is a statistical measure of the performance of a basket of stocks representing a portion of the equity market. Examples include the S&P 500 and the Dow Jones Industrial Average. These indices track the overall performance of their underlying group of stocks.

- Individual Stocks - An individual stock represents ownership in a single company. The return on an individual stock depends solely on that company's performance. Individual stocks carry higher risk but also the potential for higher returns compared to broader indices.

- ETFs (Exchange Traded Funds) - An ETF is a collection of securities bundled together into a fund that trades on an exchange like a stock. ETFs can contain various asset classes but equity ETFs typically track an equity index, such as the entire stock market or a sector. ETFs offer diversification with the trading aspects of a stock.

Shares and individual stocks represent ownership in a single company, indices track groups of stocks, while ETFs are funds containing assets like stocks or indices that trade as a single security. The level of diversification, risk, and return potential differs across these asset classes.

74-89% of retail investor accounts lose money when trading CFDs with this provider.